What You Need to Know Before You Use a Credit Repair Company

You may have seen ads or websites offering to fix your bad credit. And, if you’re really in a bind, these services may seem like the “magic bullet” you’ve been hoping for. We could all use a fresh start sometimes, so a credit repair service may be tempting. But, if hiding or erasing your negative credit history sounds too good to be true, that’s often because it is. Unfortunately, not every credit repair entity has your best interests at heart. Thanks to the internet, companies can pretend to be something they’re not, and often at your expense.

You may have seen ads or websites offering to fix your bad credit. And, if you’re really in a bind, these services may seem like the “magic bullet” you’ve been hoping for. We could all use a fresh start sometimes, so a credit repair service may be tempting. But, if hiding or erasing your negative credit history sounds too good to be true, that’s often because it is. Unfortunately, not every credit repair entity has your best interests at heart. Thanks to the internet, companies can pretend to be something they’re not, and often at your expense.

At their best, a credit repair company can identify and remove errors from your credit report (something you can also do on your own). At their worst, the company might be a sham. It’s difficult to spot the honest companies from the dishonest ones, but being able to do so can keep you from going further into debt or doing additional harm to your finances. Here’s what you need to know about credit repair.

What a credit repair company can do:

A reputable credit repair company looks at your credit reports from each of the three major credit bureaus (Experian, Equifax and TransUnion) to identify errors or false information. Then, they dispute this information to get it removed from your credit report. Having incorrect information removed from your credit report can potentially result in a credit score improvement. Legitimate repair companies will offer a variety of services aimed at improving your credit profile. These services include consultations, customized action plans, ID theft restoration and letters to creditors and collection agencies.

However, it’s important to note that these services are extremely expensive, and are services you can do yourself. If you are willing to spend the money to have a company work on your behalf, be sure to do plenty of homework before choosing your company.

When a credit repair company might be a good option:

Fortunately, not all credit repair companies are scams. In complex or difficult situations, using a (reputable!) credit repair company might be helpful if you’re prepared for the fees. Many can help you improve your credit profile by disputing incorrect information on your credit report.

A company might be able to help you if:

- You have multiple errors across multiple credit reports

- You’re the victim of widespread identity theft

- You have a debt collection that’s been sold to several bill collectors and is therefore appearing on your credit report more than once

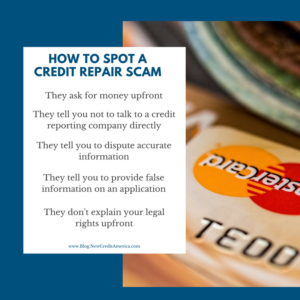

How to know if a company is a scam:

While there are some companies who can legitimately help you, the credit repair industry is unfortunately rife with bad actors. If you’re considering working with a company to remove bad information from your credit report, be careful. Be on the lookout for companies who:

- want you to give them money before they do any work for you

- tell you not to talk to a credit reporting company directly

- direct you to dispute information you know to be accurate

- tell you to provide false information on a credit or loan application

- fail to explain your legal rights upfront

- makes any kind of promise to give you a new identity or remove anything you wish wasn’t in your credit report

What you can do on your own:

If you believe there is incorrect information on your credit report and you don’t want to spend your money on a credit repair company, it is completely possible to do it yourself.

First, review your credit report for the following: incorrect information (names, dates, addresses, etc.), accounts not belonging to you, legal actions incorrectly made in your name, duplicate details, unverified debts or debts that should have aged off your report. You can do this for free at www.annualcreditreport.com. If you see incorrect information, file a formal dispute in writing with the credit bureau or bureaus in question. In addition to your name and address, your letter needs to identify the errors in question, provide evidence that the information identified is incorrect, and reasons why it should be removed. It may help to include a copy of your report with the errors circled. Send your letter by certified mail, and request a return receipt. Be sure to keep a copy of your letter and enclosed documents. Next, tell your creditor in writing that you dispute an item. Include copies of documents that support your claim. Again, include copies of your letter and enclosed documents. You can find sample letters to help you here.

Deciding to act is the first step to resolving your debt. At New Credit America, we want to help you ensure your second step is best step for you. Before choosing credit repair, debt consolidation, debt settlement, bankruptcy or any of the other options out there, do your homework. To hear more about your options and for help with a path forward, reach out to us at (877) 373-2330.