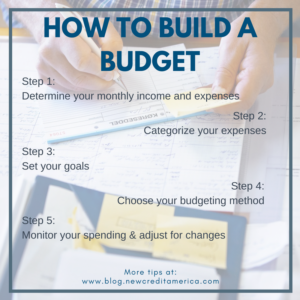

How to Build a Budget in Five Easy Steps

If you’re not sure where your money is going each month, why it constantly feels like you’re struggling to pay your bills or as though your spending habits are causing your debts to pile up—you need a budget. Even if you’re in a good place financially, having success with staying out of debt and are enjoying your financial freedom—you need a budget.

If you’re not sure where your money is going each month, why it constantly feels like you’re struggling to pay your bills or as though your spending habits are causing your debts to pile up—you need a budget. Even if you’re in a good place financially, having success with staying out of debt and are enjoying your financial freedom—you need a budget.

Developing a budget helps you create a plan and set goals for how you manage your money. It can also help you prioritize your spending to keep you out of debt. Or, a budget can help you manage your payments if you’re currently working your way out of debt. It’s also a great way to help you continue to save money (which can be a lifesaver during an unexpected life event or emergency). Having a budget helps you be in control of your financial health. Here’s how to get started.

Step 1: Determine your monthly income and expenses

The first steps of budgeting are to do an audit of your current situation so you can get an accurate picture of your financial situation and set realistic expectations and goals for your new budget. This starts with calculating your monthly income. After taxes and deductions, how much money are your bringing in every month? Add up all sources of income. Make a note of how often and when you receive this money. This will help you take note of times of the month where money is tight, so you can plan accordingly.

The next step is to make a record of what you spend every month. Once everything has been documented, compare the total of your income with the total of your expenses. Ideally, your expenses will not exceed your income.

Step 2: Categorize your expenses

Look at the expenses you recorded in step one. Break them into three categories based on their necessity. The three categories should be fixed committed expense (i.e.: rent, mortgage, car payments, bills, etc.), variable committed expenses (i.e.: groceries, gas, etc.) and discretionary expense (i.e.: recreation, entertainment, leisure, etc.). Knowing what you’re spending your money on and why will help you as you set your goals and begin adjusting your habits to meet those goals. For example, if you want to have more money left over at the end of each month to save, you will want to decrease your discretionary expenses such as going out to eat or your gym membership.

Step 3: Set your goals

Now that you know what you have coming in and going out, determine what areas need to change, and what you hope to accomplish financially. Having goals will help you to have a rhyme and reason to the choices you make. Goals can be short term to help you manage your money right now. Or, they can be long term to help you with your savings and spending over many years. Often, it can be good to have both, because the choices you make for your short-term goals can help you to achieve your longer-range goals.

The first key to setting goals is to be realistic—goals can be challenging, but they should be attainable. You don’t want to set yourself up only to fail! Then, think about your current situation and what you envision for yourself in the future. Do you want to start saving for your retirement? Are you hoping to move to a new home in the future? Maybe you’re paying off your debts and want to create a plan to stay out of debt for good. Whatever the case may be, think about what actions you can take to help you reach those goals. Learn more about setting goals for your budget here.

Step 4: Choose your budgeting method

Pick your poison! Are you an old-school pen and paper person? Or, are you a whiz when it comes to Excel spreadsheets? There are several different ways you to create and monitor your budget, ranging from writing it on paper to using free software like Mint.com. After you choose your preferred method, start recording everything from steps one and two.

Step 5: Monitor your spending to adjust for changes

Always be ready to adjust! Continue monitoring your income and expenses to see how they are either helping you meet your goals or standing in your way. Make changes if necessary. For example, if you’re still struggling with credit card debt, try ditching the plastic and using only cash. Or, if you’re saving even more money than you anticipated—treat yo’self (don’t go crazy, but a little reward is OK!). The important thing is to stay aware of your habits. Your priorities may shift, and that’s OK. You can rework your budget to reflect your new priorities.

Now that you’ve got a basic plan together, it’s time to start meeting your goals. Here are some helpful budgeting strategies to get you started. As always, your New Credit America team is here to help you on your path to financial freedom. Give us a call at (877) 373-2330.