Tax Season: What You Need to Know Before You File

We’re officially deep into tax season (groan)! If you haven’t filed your taxes yet, you have until April 17 this year. Filing your taxes can be a complicated and daunting task, made more confusing by your evolving financial situation. But, despite the headaches it may cause, filing your taxes on time means no penalties, fees or legal ramifications. If you’re getting ready to file your taxes and aren’t sure how or where to start, don’t panic. There are many different aspects to filing taxes, and it can get very complex. But, rather than getting bogged down in the weeds, here are a few simple things to consider as you start the process.

We’re officially deep into tax season (groan)! If you haven’t filed your taxes yet, you have until April 17 this year. Filing your taxes can be a complicated and daunting task, made more confusing by your evolving financial situation. But, despite the headaches it may cause, filing your taxes on time means no penalties, fees or legal ramifications. If you’re getting ready to file your taxes and aren’t sure how or where to start, don’t panic. There are many different aspects to filing taxes, and it can get very complex. But, rather than getting bogged down in the weeds, here are a few simple things to consider as you start the process.

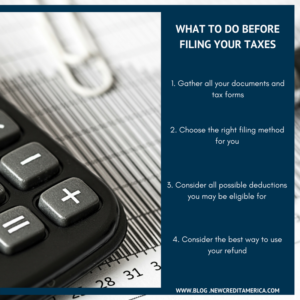

What you need before you file:

This process starts with collecting all your personal information and tax documents. In addition to your social security number, your spouse’s social security number and information on your dependents (birth dates, social security numbers, childcare records, etc.), you’ll also need any form with information on income you received or eligible deductions from 2017. For a detailed list of what you may need, here’s a handy checklist. Employers and companies must mail these forms to you by the end of January, so by now you should have everything you need.

Different ways to file:

When filing taxes, you get to choose your own adventure. Your can do your return yourself with paper and pen, use online tax software or work with an accountant or tax professional (to name a few methods). The right choice for you will depend on how complex your return is. If you have many different forms to include in your return, doing it yourself may not be your best option. If you want a simple and free or relatively inexpensive option, an online program such as TurboTax or H&R Block may be your best option. Programs like these will walk you through each step of the process and ask you questions to help you get all the credits and deductions you may be eligible for. Plus, filing online typically means you get your refund sooner. Who doesn’t love that?

If computers aren’t your strong suit, you still have options. You can obtain Tax Form 1040 from the IRS website or an IRS office. Then, fill it out and mail it in. If your return is straightforward and you’re comfortable with this form, this is a free way to file. Click here more information on how it works. Unfortunately, because you’re submitting it via snail mail you don’t have the comfort of knowing if or when it arrived.

What to consider when filing:

If you’re filing your taxes online, you will have the benefit of being asked questions that can help you maximize your deductions. These deductions can lead to a refund! Think back on your past year. Did you move, get married, pay interest on student loans or have business-related expenses(to name a few examples)? Gather up any evidence or additional forms you may need and include it in your return. Your tax program should help you identify what you’re eligible for. Just be as thorough as possible.

What to do with your tax refund:

Once you’ve completed the process, you should hopefully be expecting a refund. While it may be tempting to use your refund on something extravagant, there are more practical uses to consider. If you’re dealing with debt, use this extra money to pay down credit card debt. It may not seem like the most fun use of money, but it is the most beneficial. Another good use for your refund is to set it aside for a rainy day. If an unexpected expense occurs, you’ll have this money to cover it. If paying bills is a struggle, this money could also be set aside and used only for monthly bills you have trouble paying.

For more information and assistance on filing your taxes, check here.